How many times has this happened to your bank or financial services company? You on-board a new client, and in doing so, follow your KYC (know your customer) process, and everything works out great. But a short time later, the customer’s master profile changes — without you being made aware that the change occurred — and you are constantly worrying that the bank is exposed to new risk in the customer portfolio.

Situations like this play out every hour of every day because customers are dynamic entities with tens, and sometimes hundreds, of related parties. Their people are dynamic, their businesses are dynamic, and how they work with other businesses is dynamic. This is why banks need to know what their customers are doing — at all times.

And the only way for that to happen is by advancing from traditional KYC to perpetual KYC, also known as pKYC.

Advice to ready for pKYC and a blueprint to get there

WorkFusion and Forrester recently delved into how banks should approach pKYC. In the webinar, Forrester VP and Principal Analyst Boris Evelson describes how AI-powered document processing makes pKYC possible. As part of his analysis, he gives his perspective on automation, IDEP (intelligent document extraction and processing), and tips for selecting a vendor. Following the Forrester analysis, Daniel Hazel, VP of Strategic Accounts at WorkFusion, reveals a blueprint for moving to pKYC by using AI-powered Digital Workers.

Readying for pKYC: AI-powered document processing

Forrester’s Evelson asserts that AI-powered document processing serves as a core foundational element of pKYC. It starts with IDEP which is, far and away, the best technology available for gathering all the information needed to properly evaluate the risk of a customer during and after onboarding. IDEP extracts and processes all the relevant information to be found in documents, semi-structured data sources (e.g., articles of incorporation and trust agreements), and unstructured data sources (e.g., emails and public news sources).

It’s important to note that Evelson differentiates between two types of AI in IDEP, and that both types are needed to make it work properly. The two AI types are ‘knowledge-based AI’ and ‘ML-based AI.’ The former, he says, should already exist in an IDEP solution out of the box, because the vendor should have already pre-taught the tool with industry knowledge. The latter leverages ML for learning the content and context of different data points for continuous improvement to further optimize the extraction and processing of data from semi-structured and unstructured data sources.

Because of IDEP’s capabilities, Forrester calls out both KYC and bank customer onboarding as two key use cases for IDEP. In fact, the natural language processing (NLP) inherent within IDEP solutions is something which Evelson says is being implemented by banks today — with strong ROI.

Having in place an AI-powered IDEP solution (or ‘IDP’ as others in the industry refer to it) and processing all the needed KYC data, a bank is positioned for analyzing the data and starting a process (or workflow) to send everything to downstream KYC processes. This doesn’t just apply to text-based information. It also includes audio and images. For a deeper view into the details surrounding the handling of different content within documents, view the webinar.

Capabilities versus integrated capabilities

Evelson underscores the importance of evaluating different vendors’ IDEP solutions. A key differentiator which he calls out is an IDEP/IDP solution that provides data integrations and cleanup scripts — things a bank should never take for granted. After all, the data coming out of IDEP serves little purpose if it is not easily shared with core systems within bank operations.

This is where Daniel Hazel of WorkFusion demonstrates how AI Digital Workers really show their value in the move to pKYC. Each KYC-focused Digital Worker from WorkFusion is fully digital and comes prepackaged with AI-driven IDEP, automations to downstream processes, and the integrations and APIs needed to make the entire KYC process singular. By leveraging the data and presenting it to FinCrime operations teams, banks can transform compliance from a traditional cost center to a far more efficient function. It may even prove to become a revenue generator by enhancing customer acquisition and opening up a service for providing similar data for banking customers.

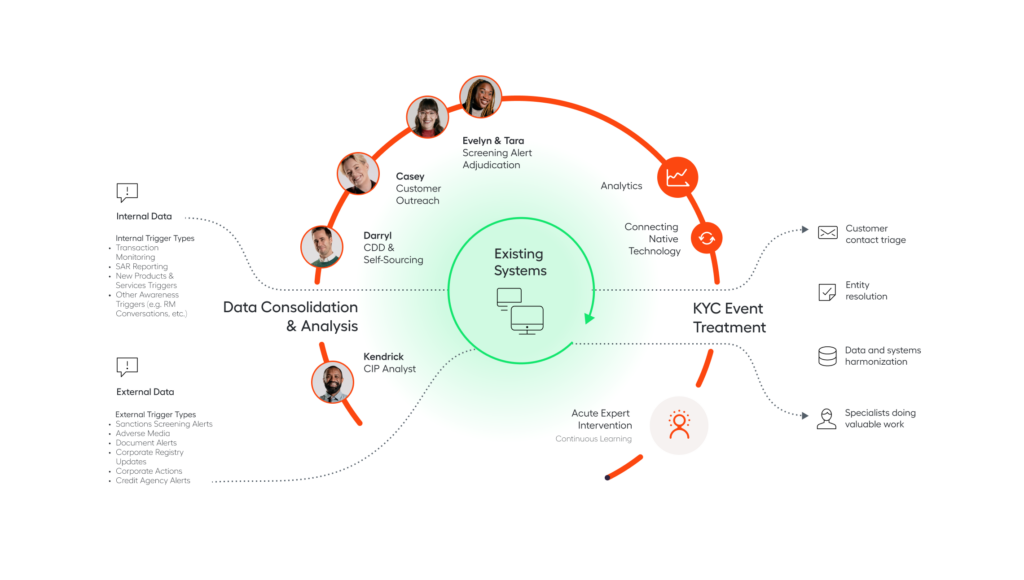

Two examples of AI Digital Workers, WorkFusion’s Darryl and Kendrick, can help automate and minimize errors in the onboarding process. Darryl is a fully digital Customer Due Diligence Program (CDD) Analyst, whose primary mission is to protect the organization from risky client relationships by collecting information and documentation to conduct due diligence on customer relationships. While Kendrick is a fully digital Customer Information Program (CIP) Analyst, who protects the organization from inappropriate client relationships by verifying the identity of individuals behind personal or corporate accounts. Once Darryl and Kendrick have completed their analysis of a customer’s data (new and old), they share their findings via KYC workflows for a highly automated KYC operation.

The webinar wrapped up with Daniel Hazel showing that, by having AI-powered document processing, automation, and APIs/integrations to multiple bank systems, AI Digital Workers set the stage for devising a pKYC blueprint. As the image below shows, the dynamic nature of AI Digital Workers and their extreme focus on FinCrime-related processes make pKYC a realistic pursuit for banks that want to always know their customers’ latest information and use it to reduce risk.

For a brief overview of the definition and dynamics of pKYC and why banks can (and should) rethink the way they onboard and review customers to reduce risk, watch this 3-minute video by two FinCrime experts from WorkFusion, Art Mueller and Daniel Hazel.

To learn more about how to approach your pKYC initiative, view the 30-minute webinar today.