Almost every large financial institution has redeveloped, or is redefining, its Customer Lifecycle Management (CLM), and related processes because of the massive disruption that has been COVID-19. Never in our lifetimes have our business continuity plans been tested to this level. Our personnel resources and operational functions, which have been key to our organizations’ success, became vulnerable overnight. Now, certainly, identification of vulnerabilities within our business is a vital step in contingency planning, so we can implement countermeasures that may prevent an incident or limit its impact if it does occur.

The next question is: Now that we have felt, in a very real and meaningful way, the impact of a critical event — how do we better plan for another one in the future?

The Financial Institution that learned quickly and wisely during the global shutdown to support its customers via automation and off-site support will come out of the pandemic better for it. This may seem counterintuitive, but it is true! By designing or redesigning your CLM to include process management powered by Artificial Intelligence, FIs can ensure that many tasks will still operate despite disruptions.

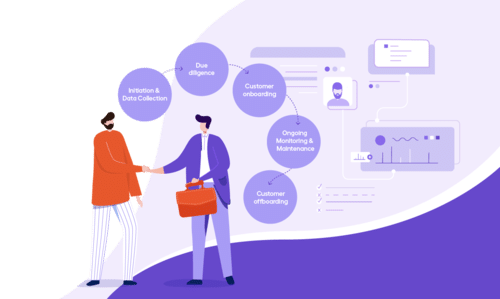

Customer Lifecycle Management covers multiple customer-related metrics that indicate business performance.

Each of these Data points functions include disparate tasks and sources of static and dynamic data, regulatory mandates, marketing processes, and value-added services to a unified decision supporting platform. The information is sourced through iterative phases of customer acquisition, retention, cross- and up-selling, and lapsed customer win-back. Without the overall workforce capacity to perform tasks, much of our performance for our customers can fall short.

Streamlining repeatable tasks is the easy part. Robotic Process Automation (RPA) has been used for years and allows us to take advantage of straight-line automation but is limited to or tasks that it is programmed to perform. The true differentiator is Artificial Intelligence; specifically, machine learning, which enables more complex tasks so customers are served without interruption.

These more complex manual tasks such as what is seen for trading desks, client services, document intake and resolution, or BSA and Compliance offices. They are often the most time-consuming as well. These can include:

- Charge-back Management

- Digital Documentation and Automated Resolution

- Know Your Customer, KYC, PKYC

- Automated Alerts Processing and Resolution

- Sanctions and Review Screening

- And more…

Automation powered by Artificial Intelligence can handle these tasks without need for additional FTE support. In many scenarios, automation can be performed without FTE monitoring or interdiction. This enables an end state that supports Customer Lifecycle Management goals across our Financial Institution’s Enterprise’s, one that allows a focus on building infrastructure, operational processes, and capacity.

A strong Customer Lifecycle Management plan replaces duplicative processes with a unified view of the customer and can respond with agility against potential disruptions. Machine learning will also produce faster and more accurate results year over year. Sophisticated automation allows business continuity plans to remain standing during disruption and allows teams within these areas to focus on more meaningful work!