A fat stack of paperwork has long been the universal symbol of the burnt-out office worker. And even with digitization, that stack weighs heavily on employees. Surging volumes and varieties of document-heavy manual work are fatigue-inducing, and workers are throwing in the towel. For highly regulated industries like banking, there’s simply no room for error in document-driven areas like FinCrime and compliance ops with 9-figure fines and reputational damage at stake.

So, what do you do when activities like classifying, routing, extracting document data and entering it across systems serve as the lifeblood of your operations, but require an army of employees? When there’s too much work and not enough workers?

Enter intelligent document processing, or IDP.

What is IDP?

Intelligent document processing (IDP) uses AI and machine learning (ML) to automate document-driven work, like capturing and validating ID documents for KYC ops, or reviewing document-like data such as payment alerts generated against sanctions lists in the case of transaction screening. These tedious tasks are complex, and require a lot of time, money and energy. The work can be simultaneously mind-numbing and involve a sort of tribal knowledge that analysts typically gain over time at their firm (and take with them when they quit). IDP allows for speed and accuracy in document handling that no human could possibly match.

While robotic process automation (RPA) heralded a revolution in automating work , rules-based RPA cannot process unstructured data or get smarter over time, limiting its ROI, scalability, and applicability. According to Gartner, 80–90% of corporate data is contained in unstructured formats, like emails and news articles.

How does IDP work?

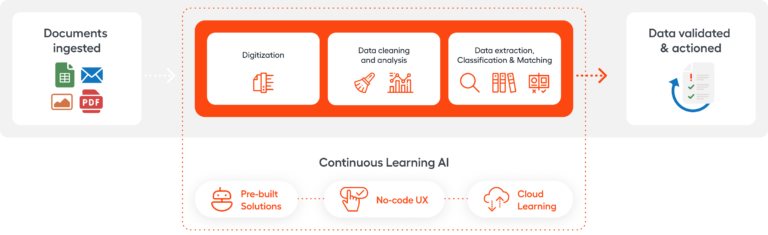

In a nutshell, IDP harnesses the combined powers of AI, ML, optical character recognition (OCR), and natural language processing (NLP) to automatically extract and process data from virtually any type of information source—structured documents, semi-structured documents (e.g., articles of incorporation, trust agreements) and unstructured content (e.g., emails, news articles).

IDP processes all sorts of documents (passports, ACORD forms, invoices) in wide variety of formats (PDF, images, Excel docs) and in 40+ languages. It’s powerful enough to recognize handwriting, signatures, checkmarks, logos, stamps, barcodes and other tricky elements, with advanced OCR and data cleansing/analysis tools—even in low-resolution documents.

The AI that powers best-in-class IDP is incredibly smart on day 1, and by nature, only improves with time. In our recent conversation with Boris Evelson, Forrester’s VP and Principal Analyst, he delineates the difference between two essential types of AI at play within IDP: knowledge-based AI and ML-based AI. The former refers to the industry-specific knowledge baked into an IDP solution (for us, banking and financial services) that is ready to go out of the box. The latter refers to the ML model’s continuous learning—from your data and that of industry peers—to bolster the model’s performance. No code or data analysts required.

Watch our conversation with Forrester for more on how AI-powered document processing makes perpetual KYC (pKYC) possible.

Why advanced IDP is non-negotiable for AML and KYC ops

For data-intensive, highly regulated industries, error-prone document work represents a pesky combination of being both low-value and high-risk. On top of that unfortunate status quo, events like the recent Silicon Valley Bank collapse teach the hard lesson that an avalanche of documents can pile onto the desks of your AML and KYC teams overnight. By automating document handling and alert disposition, an advanced IDP solution helps your teams react fast to crises and avert the alerts avalanche.

That’s great news for your teams’ energy and morale, but there’s also tremendous opportunity for time and cost savings. One U.S. investment bank told WorkFusion that it spends 250,000 FTE hours per year on document handling. Our pre-built IDP solution decreases KYC document handling time by 90%, allowing your teams to shift their focus on delivering superior customer experience. As for compliance, IDP reduces manual work to process legal structure/formation and ownership documents by 80%.

IDP: The backbone of our digital workforce

Documents are sand in the gears of banks and other FIs who would rather focus their efforts on gratifying work like delivering value and satisfying their customers rather than just staying compliant. Our suite of AI Digital Workers takes the sand out of the gears.

With IDP capabilities, these 100% digital analysts handle transaction screening alerts (Tara), name sanctions alerts and adverse media screening (Evelyn), customer ID verification (Kendrick) and customer due diligence (Darryl). As you can imagine, knowledge worker roles like these typically require lots of manual, document-based work. For Digital Workers, it’s a piece of cake.

IDP is how Evelyn and Tara each review adverse media and millions of sanctions alerts per year, reducing false positives and delivering higher data accuracy. It’s how Darryl and Kendrick stay on top of the risk profile of your customers as needed, rather than performing a KYC refresh every 1, 3, or 5 years. It’s how these analysts decrease document handling time, enable superior customer service and reduce manual work . We’re talking superhuman speed, accuracy and efficiency, and it’s only possible with AI-powered document processing capabilities.

Our proven and recognized results

What about actual results? Take LPL Financial, the leading broker-dealer in the U.S. After they partnered with us to streamline several of their critical document-handling tasks, they reaped the benefits of an 80% reduction in overall processing time, with 10% of documents processed straight through. The remaining 90% require minimal human involvement, and are handled in an average of 20 seconds each.

Deutsche Bank wanted to cut the time devoted to KYC and AML. We helped them reduce document handling time by 25–50%, saving them tens of thousands of hours every year and boosting their capacity to handle 25,000 cases per quarter.

It’s not only customers, but we’re also proud to say industry analysts like Gartner and Everest Group have routinely recognized our excellence in IDP. Everest has named WorkFusion as a leader in IDP four years in a row.

What to know before you adopt an IDP solution

While this may all sound like a no-brainer, there are important considerations to keep in mind before you select a vendor and adopt an IDP solution. We mentioned Everest evaluates IDP vendors, and so we think it’s wise to heed the advice in their white paper on key challenges to consider—like model training and data integration—before choosing and implementing a powerful, transformative capability like IDP. Because we have been listening to our customers, analyst predictions, and industry trends, we built our digital workforce to overcome each IDP challenge outlined by Everest.

Want to see how our Digital Workers’ IDP capability can transform your AML and KYC teams? Schedule a demo.