Recently, LexisNexis® Risk Solutions published the results of their in-depth study on financial crime compliance costs for U.S. and Canadian firms, The True Cost of Financial Crime Compliance. The results of the study are clear and point to the urgent need for BFSI firms to stave off FinCrime compliance costs. One way organizations can accomplish this is by taking advantage of AI-enabled Digital Workers to alleviate the skyrocketing costs to hire more and more compliance professionals.

Built and delivered out-of-the-box as AI-enabled intelligent automation, Digital Workers are specifically designed to alleviate these human costs by directly addressing the major areas where FinCrime compliance costs have risen, including sanctions screening and KYC operations.

2022’s major cost drivers of FinCrime compliance

According to the LexisNexis study, the Anti-Money Laundering Act of 2020 (AMLA) has particularly impacted U.S. financial institutions and their compliance costs. In fact, the average annual cost of FinCrime compliance operations for U.S. mid-sized and large firms (mid/large firms) grew to over $29 million in this year’s survey.

Overall, 85% of firms across the U.S. and Canada cited ‘Growth in Volume of AML Activity’ as a top external compliance cost driver. Nearly every firm, even those that did not call out AML activity as a top cost driver, is having to deal with increased costs of regulatory compliance. A staggering 87% of all firms surveyed said that more compliance regulations have increased workload volumes over the past 12 months.

The direct relationship between sanctions screening and KYC challenges

A full 73% of U.S. and Canadian firms said financial crime compliance is having a negative impact on their customer acquisition capabilities – and KYC operations must improve in speed and accuracy in order to bring down this number. Yet, KYC operations are suffering as a direct effect of sanctions screening functions that have not scaled to meet demand.

Additionally, more than two-thirds of U.S. financial institutions (FIs) rank sanctions screening as a top challenge. Among those, the larger U.S. FIs are even more likely to indicate struggles with KYC due diligence.

The two most prominent KYC due diligence challenges of 2022:

- Lacking critical identifying attributes of a business

- Identifying relationships between business entities

These gaps in due diligence data cannot be addressed by querying potential new customers. In fact, the third-most-cited challenge in KYC due diligence is ‘Non-cooperation from the business.’

The screening-KYC relationship is so intertwined that LexisNexis added special commentary surrounding it: “The rise in critical identifying business attributes as a top KYC challenge is being driven by U.S. financial institutions, particularly related to sanctions screening challenges. Canadian financial services institutions are facing more challenges with KYC due diligence, such as identifying relationships and UBOs [ultimate beneficial owners] and obtaining useful Customer Due Diligence (CDD) data.”

Hiring more sanctions screening and KYC staff is not the answer

The firms that cite sanctions screening as a top challenge are already experiencing an explosion in compliance staffing costs. Mid/large U.S. FIs that rank sanctions screening as top challenge average $39.3 million in compliance spend, versus $29.8 million for firms that don’t rank sanctions screening as a top challenge. That’s a hefty 32% cost differential for those challenged by sanctions screening.

At the same time, nearly 6 out of 10 (57%) of all U.S. and Canadian firms say they need more skilled compliance professionals to address their lack of FinCrime operations scale. But hiring additional staff in this area is neither a realistic nor cost-effective plan.

First, where will firms find all of these new, affordable compliance professionals in the aftermath of the Great Resignation? They won’t. But even if they could, the cost would be astronomical, as explained here by The OCC’s (Office of the Comptroller of the Currency) National Risk Committee and its Spring 2022 Semiannual Risk Perspective report:

“Recruiting and retaining talent with the desired level of knowledge and experience is a growing challenge in the banking sector… When combined with strong competition from both banks and nonbanks, retaining and attracting talent with the appropriate expertise is driving up bank personnel costs.”

With 6 out of 10 firms planning to hire more compliance staff, as the pool of available professionals shrinks, firms will end up paying higher prices for less-qualified people. Having too little capacity and/or less-qualified staff will lead to more errors in both the sanctions screening and KYC functions. This is not a time in which FIs should take that risk, because sanctions are growing increasingly complex on a continual basis. The OCC’s National Risk Committee addressed this issue as well in the report:

“The U.S. Department of the Treasury’s OFAC is implementing significant economic and trade sanctions imposed by the U.S. on numerous individuals and entities in response to Russia’s invasion of Ukraine. These sanctions are complex and evolving.” They went on to say, “In addition, FinCEN issued two alerts related to the Russia sanctions. The first alert advises all financial institutions to report any suspicious activity and be vigilant against potential efforts to evade the expansive sanctions and other U.S.-imposed restrictions implemented in connection with the Russian Federation’s invasion of Ukraine. The second alert advises on the importance of identifying and quickly reporting suspicious transactions involving real estate, luxury goods, and other high-value assets of sanctioned Russian elites and their family members and associates.”

All this new complexity added atop the already-challenging compliance realm begs the question, “If we can’t hire enough qualified staff for complex, evolving sanctions screening and KYC operations, what can we do to scale up?”

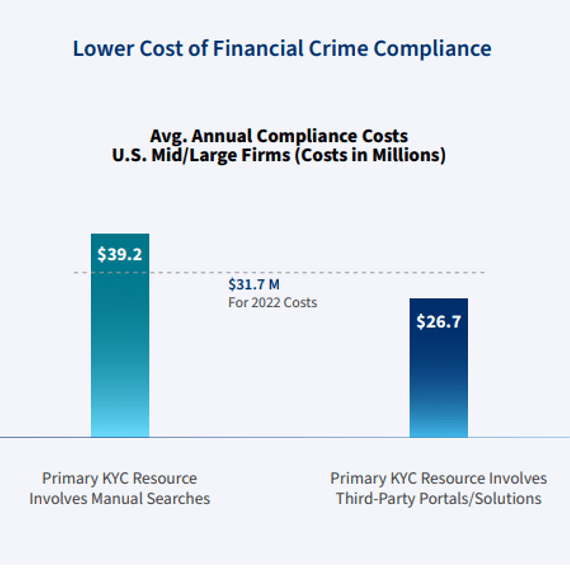

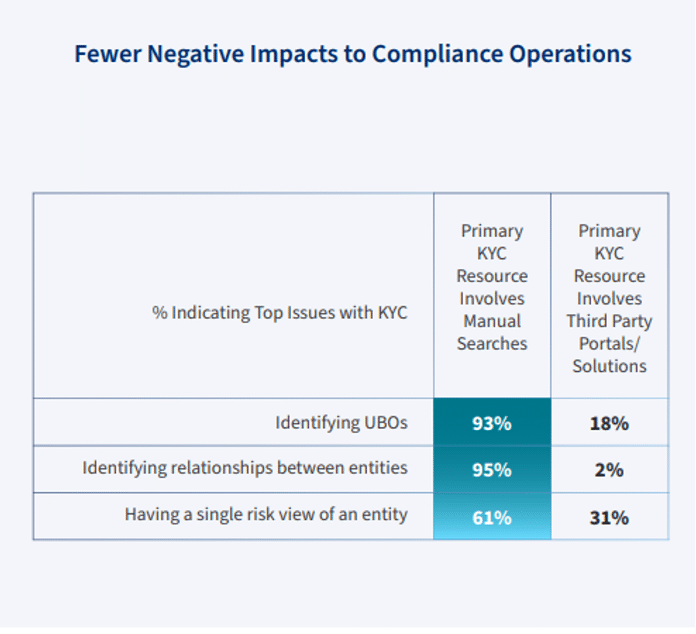

LexisNexis answers this question simply by showing that FIs can apply technology solutions to achieve the scale they need – with a significant cost advantage. According to the study findings, “Financial institutions that use third-party compliance solutions as a primary KYC/due diligence resource can experience a lower cost of compliance and greater effectiveness at identifying ultimate beneficial owners, uncovering potential criminal relationships and achieving a single risk view.” Not only does the first figure below show how much lower costs are for firms that apply technology correctly, the second figure shows a dramatic drop-off in due diligence issues.

AI-Led Digital Workers rapidly scale AML compliance

WorkFusion’s AI-powered Digital Workers are Intelligent Automation personified and they exist to scale FI compliance programs fast and cost-efficiently. Delivered as pre-built “employees,” they are intelligent automations that deploy and start working almost immediately — just 5–7 days on average.

Here are just two examples of Digital Workers that can quickly scale your compliance operations – a digital transaction screening analyst and a digital customer due diligence program analyst.

Our Digital Worker Tara is a Transaction Sanctions Screening Analyst. Tara reviews sanctions alerts in real time, protecting organizations from processing payments from sanctioned organizations and individuals. “She” also ensures fast and accurate processing of all transactions in order to provide a high standard of customer service.

Tara adjudicates L1 alerts with greater efficiency, better accuracy, and with a more comprehensive audit trail than teams of people. And “she” will also review payment messages and associated screening alerts and hits before auto-dispositioning them as either false positives or potential escalations. Tara automatically conducts research to justify decision-making and drafts human-readable justifications that are ultimately entered into your screening software’s case management workflow to provide an audit trail. Tara can also integrate with internal databases and external data providers to increase the alert review automation rate.

Our Digital Worker Darryl is a Customer Due Diligence Program Analyst. Darryl’s primary mission is to protect the organization from risky client relationships by collecting information and documentation to conduct due diligence on customer relationships.

“He” collects, indexes, validates, extracts, and inputs information regarding the entity being onboarded or refreshed. He’s pre-trained to take on these activities:

- Analyze client documents to determine fulfillment of outstanding requirements

- Ensure quick and accurate completion of all due diligence requirements for customer onboarding or periodic review

- Review documentation (e.g., trust agreements, Ultimate Beneficial Owner forms) to identify relevant individuals (e.g., beneficial owners, authorized signers) for the due diligence process

- Ensure CDD policy is consistently applied in front office by requesting missing information

Darryl’s been designed with special skills to capture full legal names from ownership structure documents, reconcile information against customer records and other documentation, detect signatures on legal documents, and even handle exceptions with human-in-the-loop capability, working side-by-side with traditional team members.

To learn how fast and cost-efficiently Tara, Darryl and other Digital Workers can help scale your compliance operations, visit WorkFusion on the web today at www.workfusion.com.