If you are an AML Ops or FIU manager, then you are likely very familiar with the following scenario:

It is day 29 of 30, and several of your transaction monitoring L1 analysts still have 25-50 alerts sitting in their individual review queue. People are calling and saying, “Hey, it’s hour 23 of day 29. What’s the status?” So now, you must act. But how? Do you tell your analysts to open a case for each of their many unreviewed alerts and buy everyone an extra 30 days for each alert? This kicks the ‘backlog can’ further down the road and adds to next month’s load of cases to address. Do you throw caution to the wind and push your analysts to fly through their reviews, risking poor quality scores and missed escalations in the process?

Neither option is good. You ask yourself how you got into this mess. Yet, at this point, you don’t have the luxury of taking the time to analyze the root cause. That is something you should have asked yourself about last month – when the same thing happened. Perhaps you didn’t ask, because you didn’t want to face the obvious answer, which is that your some of your analysts, quite frankly, may have procrastinated for days on end at the outset of each month. They surf the web, shop online, and pretty much do anything to avoid the repetitive slog of performing lengthy alert reviews when they know that 90-95% of them will turn out to be false positives.

There. We said it. So now that the truth is out, how do you avoid this situation from repeating next month?

Alleviate the L1 analyst busy work

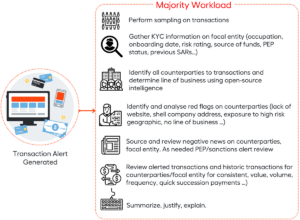

TM analysts want to spend their time where their true talents can shine – fighting financial crime. Unfortunately, they spend 80-85% of each day performing busy work, most of which is tracking down information from multiple systems just to get started with a single alert. Once they obtain all that data, they need to narrow it down to the information that’s required to support an investigation. As a result, TM analysts spend the majority of their day performing a lot of time-consuming and laborious work as part of an alert investigation, even for a simple alert. The following image breaks down the common TM alert investigation workload placed on an L1 analyst.

Imagine spending your day going through all that effort only to find that 90-95% of the alerts are false positives. It’s little wonder that L1 analysts are procrastinating on their investigations.

This is where AI, and in particular AI Agents, can alleviate the ‘busy work’ burden placed on your L1 analysts. WorkFusion’s newest AI Agent, Isaac, acts as an AI Transaction Monitoring Investigator to help overcome these common issues. Isaac assists with TM alert management and investigations by using machine learning capabilities to work L1 alerts. He auto-escalates alerts that are likely to require investigation and closes or tees up alerts for an analyst to review that are non-suspicious with supporting narrative and documentation, allowing your analysts to focus on the highest-risk activity – the stuff that gets them excited about being financial crimes investigators!

Referring to the below image, AI Agent Isaac takes over the “Majority Workload” normally performed by humans. Using a dossier that Isaac compiles to summarize and justify his findings, analysts can easily read through the data and narrative, as opposed to the time-consuming tasks of searching and compiling data. This transforms analysts from authors to editors.

The benefits of leveraging AI Agent Isaac for your L1 TM alert reviews come in multiple areas. First, as an AI solution, Isaac never procrastinates and starts to investigate L1 alerts as soon as your TM system (I.e. Nice Actimize, SAS, Verafin, etc.) issues them. This will put an end to your day-30 scrambles.

Another benefit from Isaac is that the quality of your L1 alert reviews will skyrocket. Instead of rushing through a massive backlog and clearing it out with hasty, poorly justified decisions, you gain well-reasoned narratives for each alert, whether it results in a false positive disposition or an escalation to L2.

Finally, your L1 analysts evolve from demotivated, low-performing employees to highly interested financial crime investigators who stay with your business longer and make your business perform, with lower risk.

To learn more about Isaac, visit his dedicated page to fighting financial crime via optimized transaction monitoring alert review.