Innovation in emerging markets has enabled many nations to ‘leapfrog’ once-leading western nations in certain infrastructure areas. Most infamous among these is mobile communications, wherein great swaths of Asia, the Middle East, and Africa leapfrogged the west – particularly the United States – with advanced mobile networks and devices.

A similar leapfrogging has been underway in the United Arab Emirates (UAE) in recent years in the area of Anti-Money Laundering, Countering the Financing of Terrorism and Proliferation Financing (AML/CFT/CPF). With UAE leaders determined to continue Dubai’s prominence as a modern international financial hub, they recognized the need to ensure stability via a robust, policy-driven and tech-enabled regulatory regime surrounding financial crime prevention.

UAE ideally positioned for innovation in FinCrime prevention

The ruling families in the UAE enjoy a high degree of legitimacy, and as such, decision-making is relatively easy to centralize when it comes to major initiatives like the UAE’s National Strategy on Anti-Money Laundering and Countering the Financing of Terrorism. Combining this centralized focus with the array of modern technologies capable of improving the fight against FinCrime, the UAE found itself in the ideal position to rapidly improve its regulatory regime. As noted in the BTI 2024 UAE Country Report, “The structural constraints for the UAE’s governance ability are minimal.”

As for the technological side of the equation, consider recent examples in the banking sector. Citi and Emirates NBD have collaborated to launch 24/7 US Dollar cross-border payments in the Middle East.

The UAE also recently enabled unified payments for interbank peer-to-peer and person-to-merchant transactions via a phone app at UAE-based Mashreq’s Neopay terminals in retail stores, dining outlets and tourist attractions. “With the widespread adoption of mobile phones, leapfrog innovation in the banking sector has been made possible through the use of unified payment interface (UPI),” said Srikumar Ramanathan, Senior Vice President at Mphasis (a strategic WorkFusion partner).

In a recent article, Why the Middle East Could Leverage Open Banking Best Practices to Leapfrog Other Regions, International Banker stated that Bahrain, the UAE and the Kingdom of Saudi Arabia have all adopted open banking more rapidly than Europe. It also underscored how the Gulf states have successfully shared their knowledge and experiences.

Improving and streamlining FinCrime compliance

Following approval by the UAE Cabinet on September 2, 2023, the country announced a National Strategy for Anti-Money Laundering, Countering the Financing of Terrorism and Proliferation Financing (AML/CFT/CPF) for the years 2024-2027. The strategy was formulated with reference to the latest UAE National Risk Assessment, which was developed using the World Bank Group’s methodology, to align with international standards. Private sector members played a key role by participating in the final stage consultations.

Shortly after the announcement of the National Strategy, the Financial Action Task Force’s (FATF) removed the UAE from its Grey List in February 2024, as it did with Jordan in 2023. The move further underscores the UAE’s progress toward upholding international standards. The FATF’s February 23, 2024 update stated, “The FATF welcomes the UAE’s significant progress in improving its AML/CFT regime. The UAE strengthened the effectiveness of its AML/CFT regime to meet the commitments in its action plan regarding the strategic deficiencies that the FATF identified in February 2022.” The FATF noted six key areas of progress by the UAE:

- Increasing outbound MLA requests to facilitate ML/TF (money laundering and terrorism financing) investigations

- Improving understanding of ML/TF risks of DNFBP (Designated Non-Financial Businesses and Professions) supervisors, applying effective and proportionate sanctions for AML/CFT noncompliance involving FIs and DNFBPs, and increasing STR filing for those sectors

- Developing a better understanding of risk of abuse of legal persons and implementing risk-based mitigating measures to prevent their abuse

- Providing additional resources to the FIU to increase its capacity to provide financial intelligence to LEA and making greater use of financial intelligence, including from foreign counterparts, to pursue high-risk ML threats

- Increasing investigations and prosecution of ML

- Ensuring effective implementation of TFS through sanctioning noncompliance among reporting entities and demonstrating a better understanding of UN sanctions evasion among the private sector.

According to a statement posted to the UAE Ministry of Foreign Affairs, His Highness Sheikh Abdullah bin Zayed Al Nahyan, Deputy Prime Minister and Minister of Foreign Affairs, and Chairman of the Higher Committee Overseeing the National Strategy on Anti-Money Laundering and Countering the Financing of Terrorism said, “The UAE’s proactive approach not only safeguards the integrity of the global financial system but also strengthens our position as a leading international financial center and trade hub.” Business leaders couldn’t agree more

Commenting in Fast Company’s article, How UAE is gaining trust in the world’s financial system, Simon Sharp, Partner at Global Ventures, noted, “In the UAE, fintech, which thrives in environments with regulatory clarity, is expected to grow from $3.16 billion in 2024 to $5.71 billion by 2029, which will benefit startups, global players, and potential unicorns.”

Hisham Farouk, CEO of Grant Thornton UAE, highlighted that the more robust regulatory strategy and actions taken by the UAE improves the nation’s overall economy: “There is also increased activity across industries such as real estate, e-commerce, and technology, bolstered by a strong legislative environment and increased compliance controls,” Farouk stated.

None of this should surprise anyone

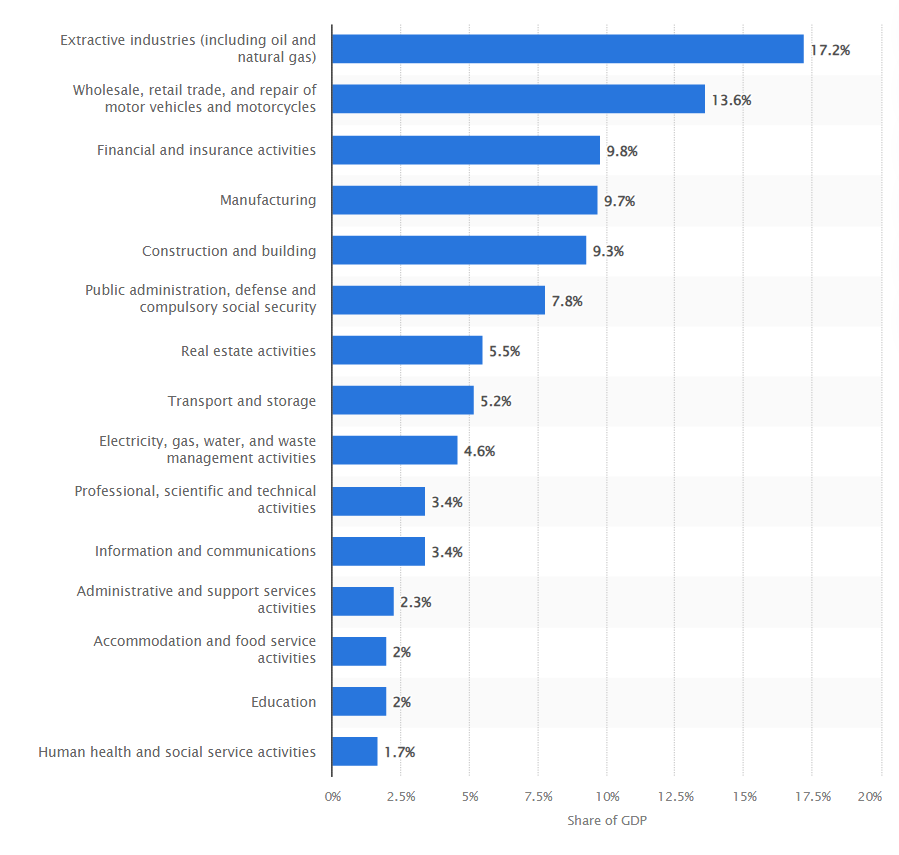

The UAE has developed rapidly and purposefully since the 1970s, when its economy was characterized by fishing, trading and agriculture. In just 50 years, it has transformed into a wealthy and economically diverse nation. Beyond the oil & gas sector, the UAE has become a major financial hub and developed many other industries in recent years. These include retail, e-commerce, manufacturing, construction hospitality and tourism, logistics and transport, real estate, healthcare, and more.

Today, the finance industry is the UAE’s third-largest sector, representing 9.8% of GDP. According to Arabian Gulf Business Insight, “The UAE’s non-oil GDP grew by 4 percent year on year in the first quarter of 2024, driven by increased financial and insurance activities in the private sector.”

As the UAE continues down its path to not only modernize, but to also differentiate its finance sector on the global stage, the nation will further gain the confidence among global entities that will enhance trade and investment in the UAE, shielding it even further from the economic impact of fluctuating oil prices and reducing its reliance on the oil and gas sector overall. Given the UAE leadership’s hyperfocus on making Dubai a major global financial hub, we can expect further innovation and effective regulatory oversight to continuously ensure the safety and credibility of the UAE financial system.

Just recently, WorkFusion announced a partnership with Advanced Financial Solutions, a company within MDS SI Group, to help meet the growing demand for AI-based solutions in the Middle East

To see how financial institutions in the Middle East and across the globe are complying with new government regulations while improving their fight against FinCrime with technologically advanced AI Digital Workers, request a demo today.