Governments and multinational bodies impose economic sanctions to try to alter the strategic decisions of state and nonstate actors that threaten their interests or violate international norms of behavior. Sanctions are meant to influence the behavior of other nations and individuals and are intended primarily to restrict or block access to financial resources to affect change in policies or courses of action in order to regain access to those resources. Sanctions are most often used to prevent conflict escalation, illegal arms trading, nuclear proliferation, terrorism, and financial crime.

Sanctions are imposed by governments through acts of legislation and interpretative guidance administered by specific government agencies. In the U.S., the Office of Foreign Assets Control (OFAC) plays a principal role in administering and enforcing most U.S. sanctions. Similarly, U.K. sanctions programs are run by the Office of Financial Sanctions Implementation (OFSI) while enforcement of European Union sanctions is primarily the responsibility of EU Member States, upon adoption by the EU Council. The United Nations Security Council (UNSC) issues sanctions on behalf of UN Member States, who are expected to enact appropriate legislation to ensure efficacy of UN sanctions.

With sanctions dictating a range of financial restrictions against their targets, banks and other financial institutions (FIs) must screen against these state and nonstate targets to ensure regulatory compliance. Firms that fail to comply with sanctions regulations often incur significant fines and penalties – as well as reputational damage from public exposure of doing business with (or for) sanctions targets.

Delving into OFAC sanctions programs and lists

The most well-known OFAC list is the SDN list, or the Specially Designated Nationals (SDN) and Blocked Persons List. It is a list of approximately 12,000 names connected with sanctions targets that are owned or controlled by, or acting for or on behalf of, targeted countries. It also lists individuals, groups, and entities, such as terrorists and narcotics traffickers designated under programs that are not specific to any country. Collectively, such individuals and companies are called “Specially Designated Nationals” or “SDNs.” Their assets are blocked, and FIs are generally prohibited from dealing with them.

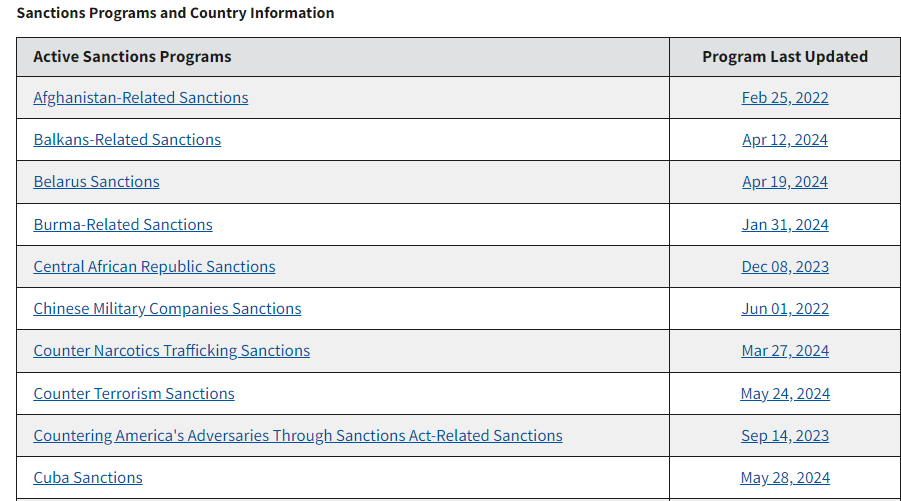

OFAC establishes and maintains a large number of sanctions programs and associated lists – currently 38 such programs. Here’s a snapshot of the first 10 sanctions programs listed on the OFAC site.

OFAC does not maintain a specific list of countries that U.S. persons cannot do business with. This is because U.S. sanctions programs vary in scope. According to OFAC, some are broad-based and oriented geographically (i.e. Cuba, Iran). Others are “targeted” (i.e. counter-terrorism, counter-narcotics) and focus on specific individuals and entities. These programs may encompass broad prohibitions at the country level as well as targeted sanctions. Due to the diversity, OFAC advises visiting the “Sanctions Programs and Country Information” page for information on a specific program. A great convenience of this page is that each sanctions program has its own dedicated sub-page where a wealth of data and context is given for it. Four extremely useful tools on each page are:

Important advisories and information. Advisories often highlight the sanctions evasion tactics employed by sanctions targets so that parties subject to U.S. and/or United Nations sanctions can implement appropriate controls to ensure compliance with their legal requirements.

Recent relevant legislation and authorities. Programs represent the implementation of multiple legal authorities. Some authorities are in the form of executive orders issued by the President. Other authorities are public laws (statutes) passed by the U.S. Congress. These authorities are further codified by OFAC in its regulations which are published in the Code of Federal Regulations (CFR). OFAC may also implement UNSC resolutions.

Sanctions brochures. Overviews of OFAC’s regulations with regard to the specific sanctions program serve as quick reference tools.

Interpretive guidance. OFAC issues interpretive guidance on specific issues related to the sanctions program. These interpretations of OFAC policy are published in response to a public request for guidance or released proactively by OFAC to address a complex topic.

In addition, here is a common list of program-specific information that is often provided on each sanctions program page:

- FAQs

- Proclamations

- Executive Orders

- Determinations

- Statutes

- Code of Federal Regulations

- Federal Register Notices

- Associated United Nations Security resolutions

Exceptions to sanctions programs and lists

Not everyone doing business with a sanctioned government or sector is breaking the law. For example, despite a broad sanctions program targeting North Korea, certain activities related to North Korea may be allowed if they are licensed by OFAC. In situations such as this, OFAC issues guidance and statements on specific licensing policies as they relate to the sanctions target. This information about exceptions is listed near the bottom of each sanctions program page (where applicable). It also includes a link to where parties can apply for an OFAC license online to engage in a transaction that otherwise would be prohibited.

Why does OFAC allow such exceptions? According to OFAC, it may be in your and the U.S. government’s interest to authorize particular economic activity related to a specific sanctions program.

OFAC maintains additional sanctions lists not found on the “Sanctions Programs and Country Information” page. These additional sanctions lists tend to be more dynamic and currently include the following, taken as a snapshot from the OFAC website:

Keeping up with OFAC’s SLS

OFAC has released its new Sanctions List Service (SLS) application. As the new primary application to deliver sanctions list files and data to the public, it allows users to retrieve custom list data in a variety of layouts.

An even easier way to stay updated and in compliance with the large number of sanctions programs is to leverage sanctions screening technology that does the work for you. That’s what many large and small FIs do each day with the help of WorkFusion’s AI Agents, called Tara and Evelyn.

Evelyn is an AI Level 1 analyst that reviews and dispositions sanctions alerts and drastically reduces the number of false positive sanctions hits, and Tara is an AI transaction screening analyst that reviews and analyzing alerted payment messages (e.g., SWIFT messages) to decide whether the alert is valid or a false positive. If a transaction cannot be confirmed as a false positive, Tara escalates to an analyst for further review. Each AI analyst can help your team manage alert surges, normalize spikes, avoid missing true positives, and streamline your overall sanctions compliance program.

To learn more, visit www.workfusion.com today.